Financing Your Roof Replacement: A Guide to Loans and Payment Options in Savannah, Georgia

June , 2023 | 8 min. read

By Joe Martinez

A sturdy, resilient roof over our heads is something we all wish for in Savannah, Georgia. But when the need for roof replacement unexpectedly arises, it often comes with a hefty price tag. Considering a residential roof replacement and having a rough idea of its costs is the first step. The next logical step is to explore the many financing alternatives at your disposal.

Here at RoofCrafters, we've assisted thousands of Savannah homeowners over the past 30 years. We've ensured their homes are protected by high-quality roofs. All the while, getting their new roof without causing significant financial strain. Be it metal roofing, synthetic slate, or lifetime asphalt shingles, we've made dreams come true. We've also helped clarify the complexities of roof financing and guided them to the right financial institutions.

So, if you're in the Greater Savannah area and seeking to learn about roof financing, you're in for a treat! We're about to unravel answers to some of the most frequently asked questions we encounter about roof loans. We've also put together a short video below if you'd prefer to watch it.

Let’s dive right in!

Understanding Roof Loans in Savannah, Georgia

Available up to a considerable $75,000. Roof loans in Savannah, Georgia come with no down payment. They're also simple interest and are devoid of any early payoff penalties.

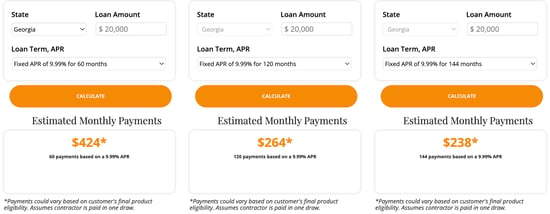

Interest rates for roof loans typically range between 7.99% and 12.99%. They offer varied loan terms of 60 months, 120 months, or 144 months. To give you an example, for a roof costing $20,000, your monthly payment could be $464 for a 60-month term. A $20,000 roof would be $268 per month for a 120-month term, or $238 for a 144-month term with zero down payment.

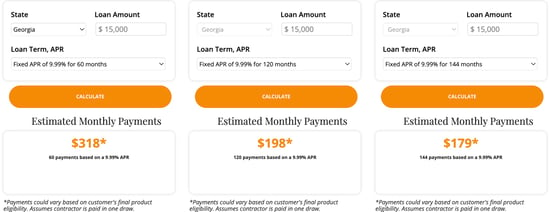

When it comes to a $15,000 roof, the monthly payment would be $318 for 60 months, $198 for 120 months, or $179 for 144 months, again, with no down payment.

The majority of homeowners in the United States, including Savannah, Georgia, prefer a 10-year or a 120-month term loan. This popular roof loan provides homeowners with heightened flexibility. Keep in mind, you can always opt to pay off the loan early without incurring any penalties. A roof loan is a simple interest loan.

To aid homeowners in Chatham County, we at RoofCrafters have partnered with Sunlight Financial. We can offer some of the best roof loans available. Thanks to Sunlight's flexible payment options and a seamless home improvement loan experience. They also provide stellar support from the loan approval phase to project completion and beyond.

As we've mentioned before, Sunlight loans can be paid off early without any prepayment penalties.

Unveiling Interest Rates for Roof Loans in Savannah, Georgia

Contrary to many economic trends in the post-pandemic climate. Interest rates for roof loans have remained consistent. With our partners at Sunlight Financial, these rates kick off at a modest 7.99% and extend up to 12.99% for the majority of roof loan plans.

The rate you qualify for will be determined by two critical factors. The first one is your credit score, and the second is your household's debt-to-income ratio. Both factors play a significant role in shaping your roof replacement loan interest rate in Georgia.

What do Roof Loan Financial Lending Companies Consider “Good Credit”?

Instead of only discussing “good credit” in this section, let’s go over the brackets used for credit score standings. This will provide you with a better understanding of credit score standings.

720 and up is an excellent credit score

- You shouldn’t have any trouble getting your roof financed with this credit score in this range.

- You’ll also qualify for a roof loan with lower interest rates.

660 to 719 is a good credit score

- You will be approved to borrow more money, which may result in a no-money roof loan.

- You’ll also qualify for lower interest rates.

600 to 659 is a fair credit score

- You may not be able to borrow as much money as a good credit customer, which means you may be required to put some money down to qualify for your roof loan.

- You will still get better interest rates than a poor credit customer.

599 and under is a poor credit score

- You may be required to put more money down

- You’ll likely only qualify for particular loans at higher interest rates

Keep in mind that lenders want to see a positive payment history with only a few late payments. Lenders will also consider your debt-to-income ratio. To make sure you are not overleveraged for your total family household income. A good number for the debt-to-income ratio is 55% debt to your total household income.

One of the best parts about applying for a roof loan through RoofCrafters using our partners at Sunlight is they offer pre-qualifying. That means they are able to conditionally approve you without any impact on your credit score.

Sunlight is able to do this by doing what is called a soft pull, which is a “soft credit” check. No social security number or financial documents are required to do a soft credit pull. In most cases, your name, your address, and your phone number are all that are required to get you pre-qualified for your roof loan.

Once you have been pre-qualified, you will be ready to proceed with the roof loan. After being pre-qualified we can determine your monthly payments. Once we have a plan that fits your budget we will have them proceed with the full application.

What If I Have Poor Credit?

- Raise your credit score

- Apply for a “special” poor credit loan

- Find a co-signer or co-applicant

- Get a secured loan

1. Raise your credit score

It’s good to get your credit score as high as you can. The higher your credit score the lower your interest rate will be for your roof loan.

The fastest way to raise your credit is to pay off debt. You can check for errors and dispute them or hire a credit repair service and allow them to handle increasing your credit score.

2. Apply for a “special” poor credit loan

There are some lending companies that offer special loans for borrowers who have low credit. You can expect to pay higher interest rates for these roof loans. The good news is you can still get the new roof. And when you pay off these higher-interest loans it'll raise your credit for the next time you need to borrow money.

To make financing available for applicants with lower credit scores. Our partners at Sunlight Financial have a special program. If you get denied roof financing because of your credit score or your debt-to-income ratio you may still be eligible for a special loan. You'll be required to meet their qualifications for this loan type.

3. Find a cosigner or co-applicant

If you have a cosigner or co-applicant that person can help you qualify for the roof loan. They may help you qualify to get a better interest rate too.

Having a cosigner is another way to get your roof financed. They could help you get a much better loan agreement if your credit score is too low.

4. Get a secured loan

You could get a secured equity loan from your local credit union or your bank using the equity in your home, auto, or some other collateral.

- Home equity line of credit (HELOC)

- Borrow against your 401K

- Auto line of credit

These are just a few of the more frequently used options for getting a secured loan.

Documentation Checklist: What You Need for Roof Financing Approval

- Full legal name

- Address of your home

- Social Security # matching legal name

- Total Household Income (may require W-2s or tax returns)

Navigating Roof Financing in Savannah: An Empowering Conclusion

Indeed, many clients in Savannah and beyond opt to finance the most affordable roofing materials. Once you are qualified, the choice of how much to finance for your roof replacement is entirely in your hands.

Remember, there are no prepayment penalties associated with roof loans. So choosing to pay off your roof loan early could result in significant savings in the long term.

We trust the information we've shared has illuminated the ins and outs of roof loans and financing. If you have any other queries about financing your roof, our family at RoofCrafters is ready and eager to assist. We're committed to helping you make the best decision to safeguard your home and your loved ones. Click the schedule an inspection to have an estimator come out.

If you're curious why so many of our Savannah clients are switching to metal roofs, take a look at our guide on the best metal roof and the average cost to install metal on your home.

At RoofCrafters, our mission is to provide job opportunities for others to thrive and grow while making a meaningful impact within our communities.