Why Your Roof Might Be Uninsurable: Key Factors to Know

July , 2024 | 8 min. read

A secure and well-maintained roof is a critical component of any home, offering protection from the elements and ensuring the longevity of any humble abode. However, not all roofs are created equal regarding insurance coverage. Have you ever wondered what could make a roof so unpopular that even insurance companies want to distance themselves from it?

After spending over 3 decades in the roofing business, RoofCrafters can tell you that insurance companies carefully assess the insurability of roofs based on various factors, and sadly, several elements can lead to the classification of a roof as uninsurable or result in higher insurance premiums.

So, if you feel as though your roof is a lot like me in middle school and it's not getting the recognition it deserves (from your insurance company, of course), you’re in the right place! In just a few short moments, you’ll learn the key factors that could be contributing to your homeowner’s insurance provider turning a blind eye to you, 10 ways you could potentially lose roof coverage in the future, and lastly, your next steps. Let’s get started, shall we?

What Makes a Roof Uninsurable?

Several factors can make a roof uninsurable or result in higher insurance premiums. Insurance companies assess the insurability of a roof based on its condition and risk factors.

Here are some common reasons a roof might be deemed uninsurable:

.png?width=1200&height=200&name=Recommended%20Reading%20(37).png)

The Impact of Roof Age on Insurability

Age: Roofs have a finite lifespan, and older roofs are more likely to be uninsurable. Many insurance companies consider roofs over 20-30 years old as high risk and may refuse to provide coverage or offer it at a higher cost.

How Poor Maintenance Can Affect Roof Insurance

Poor Maintenance: Neglected roofs with significant damage or wear and tear may be considered uninsurable. Regular maintenance, such as fixing leaks, replacing damaged shingles, and keeping the roof in good condition, is essential for insurance eligibility.

Roofing Materials and Insurance Challenges

Material: The type of roofing material can impact insurability. Roofs made from high-risk materials such as cedar shakes or certain types of wood may face difficulties in securing insurance.

Influence of Previous Claims on Roof Insurability

Previous Claims: A history of claims related to roof damage can make it challenging to obtain coverage. Frequent or severe claims signal higher risk to the insurance company. They may decide to drop coverage or exclude your roof.

Geographic Location and Roof Insurance Issues

Geographical Location: The location of your home matters, especially in regions prone to natural disasters such as hurricanes, tornadoes, or wildfires. Homes in high-risk areas may face insurance difficulties, and the condition of the roof is crucial in such cases.

Importance of Wind and Hail Mitigation Features

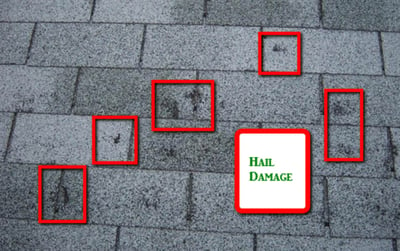

Lack of Wind or Hail Mitigation Features: In areas prone to severe weather conditions, insurance companies may require specific roof mitigation features like hurricane straps, reinforced roofing materials, or impact-resistant shingles. Without these features, obtaining insurance may be difficult.

Why Inadequate Roofing Systems Fail to Meet Insurance Standards

Inadequate Roofing Systems: Roofs with inadequate drainage, insufficient slope, or poor ventilation are at a higher risk of damage and may not meet insurance standards.

Roofing Code Compliance and Insurance

Roofing Code Compliance: If your roof does not meet local building codes or has been constructed without permits, this can result in insurance challenges.

Consequences of Multiple Layers of Roofing

Multiple Layers of Roofing: Insurance companies may be hesitant to provide coverage for roofs with multiple layers of shingles. They prefer roofs with a single layer for better performance.

The Role of Roofing Contractors' Reputation in Insurance Decisions

Roofing Contractors' Reputation: The quality of the original installation and the reputation of the contractor who installed the roof can affect insurability. A poorly installed roof may not meet the insurer's standards.

Steps to Improve Roof Insurability

To improve your chances of insuring your roof or obtaining more favorable insurance rates, consider regular roof maintenance, repairs, and upgrades, especially if you live in an area prone to weather-related risks.

Additionally, working with reputable contractors and staying up-to-date with local building codes can also help make your roof more insurable. It's important to consult with roofing and insurance professionals and get an inspection to assess its insurability.

Understanding Why Homeowners Might Lose Roof Insurance Coverage

Nobody wants to receive a coverage denial letter. Opening your mailbox or email and finding a non-renewal letter is not a good experience. Homeowners may lose insurance coverage for their roofs due to several reasons, many of which are related to the information above.

Here are the 10 most common reasons why this might happen:

.png?width=778&height=130&name=Recommended%20Reading%20(39).png)

- Roof Age: Insurance companies often consider the age of a roof when determining coverage. Roofs have a limited lifespan, and those that are too old (typically over 20-30 years) may be ineligible for coverage, or the homeowner may receive a reduced payout in case of damage.

- Lack of Maintenance: A poorly maintained roof can be grounds for coverage denial. Regular upkeep, including fixing leaks, replacing damaged shingles, and addressing issues promptly, is essential to maintain coverage.

- Previous Claims: If the homeowner has filed multiple claims related to roof damage, the insurance company may consider them a higher risk and might drop coverage or significantly raise premiums.

- High-Risk Roofing Materials: Some roofing materials, such as wood shakes, may be considered high-risk. Using these materials can result in insurance difficulties or increased premiums.

- Geographical Location: Homes in areas prone to natural disasters like hurricanes, tornadoes, or wildfires may be at risk of losing insurance coverage if the roof is not adequately prepared to withstand these conditions.

- Inadequate Roofing Systems: Roofs that lack proper drainage, slope, or ventilation may not meet insurance standards and can result in coverage issues.

- Roofing Code Compliance: If the roof does not meet local building codes or was constructed without the necessary permits, this could lead to a loss of insurance coverage.

- Roofing Over Existing Layers: Some insurance companies may not provide coverage for roofs that have multiple layers of shingles. They often prefer roofs with a single layer for better performance.

- Roofing Contractors' Reputation: The quality of the original installation and the reputation of the contractor who installed the roof can impact coverage. A poorly installed roof may not meet the insurer's standards.

- Refusal to Make Necessary Repairs: If the insurance company determines that certain repairs are needed to bring the roof up to their standards, and the homeowner refuses to make these repairs, it can lead to a loss of coverage.

To avoid losing insurance coverage for your roof, it's essential to maintain it properly, address issues promptly, and make necessary repairs or upgrades. Additionally, working with reputable contractors for installation or repairs and ensuring that your roof complies with local building codes can help maintain coverage and reduce the risk of insurance-related issues.

Conclusion: Ensuring Your Roof Stays Insurable

As you now know, several factors can render a roof uninsurable or lead to difficulties in securing insurance coverage. These factors primarily revolve around the age, condition, and location of the roof, as well as the homeowner's diligence in maintaining it. An aging or poorly maintained roof, the use of high-risk materials, a history of claims, and geographic vulnerability to natural disasters are all key determinants of insurability.

Additionally, the compliance of the roof with local building codes and the reputation of the roofing contractor are important considerations. To maintain insurability and minimize the risk of losing coverage, homeowners should prioritize regular maintenance, necessary repairs or upgrades, and adherence to local building standards.

Consulting with insurance professionals for guidance and staying proactive about roof care can help ensure that the roof remains insurable and adequately protected. If you’re past due for an inspection or are looking for a little roofing TLC, be sure to hit the “Schedule My Inspection” button down below, and one of our professionals will examine your roof’s health in-depth and help to make sure you maintain your coverage!

My name is Cassie, and I’m the Content Manager here at RoofCrafters. I was born and raised in Chicago, Illinois, and made my way out to Florida post-college graduation. I’m incredibly passionate about writing and creating valuable content that helps others with the collaboration of my marketing team. When I’m not working, I enjoy shopping (a little too much), spending time at the beach, and reading!