Navigating Roof Repair Coverage: Understanding Homeowners Insurance

December , 2023 | 11 min. read

Are you grappling with the stress of an unexpected roof repair and wondering if your homeowners' insurance will cover the costs? Roof repairs are often costly and untimely, posing a significant financial challenge. The prospect of shouldering the entire expense out of pocket can be daunting, adding to the already stressful situation. We get it.

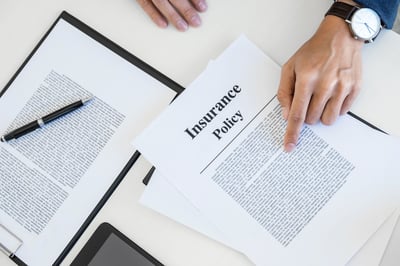

It's crucial to know what your policy covers and the conditions under which it applies. Our team of storm damage specialists at RoofCrafters has been navigating this field for 3 decades. We recognize the importance of understanding homeowners insurance when it comes to roof repairs. The question of whether homeowners insurance will cover roof repair is not a simple yes or no. It often depends on various factors, including the cause of damage and the specifics of your insurance policy.

In this article, we will delve into the details of homeowners insurance coverage for roof repairs. You'll learn about the types of damages covered and those that might fall outside your policy's scope. Our goal is to provide you with clarity and guidance, so you can navigate your insurance claims with confidence and ease. Understanding your coverage can make a significant difference in how you manage roof repair costs. Hopefully reducing the burden of unexpected expenses.

Let's explore the essentials of homeowners insurance and roof repairs.

Understanding Homeowners Insurance Coverage for Roof Repairs

Homeowners insurance covering roof repairs is crucial for unexpected damages. Your insurance policy will cover roof damage from unexpected events or natural disasters. Yet, the extent and specifics of this coverage can vary based on your insurance plan

Most homeowner’s insurance carriers cover the following incidents:

-

Fires: If your house catches on fire, you are eligible for insurance coverage even if a natural disaster is not covered by insurance.

-

Vandalism: Most standard insurance policies cover any acts of vandalism caused by a third party.

-

Falling objects: Objects falling on the roof can cause severe structural damage. Insurance covers damage caused by objects falling during storms, but might not be applicable for all types of impact damage.

-

Settling: Your homeowner’s insurance covers damage caused by excessive settling that often results in cracks or structural damage to your roof.

-

Storms: During storms, any roof storm damage is covered by your homeowner’s insurance regardless of whether a strong wind blew off your shingles or heavy rain caused roof leaks.

Most policies cover accidents, however, keep in mind that if you ask your insurance provider, many companies deny coverage at first and it is up to you to know the exact details of your policy.

Scenarios Where Homeowners Insurance May Exclude Roof Repair Coverage

Knowing what your homeowners' insurance policy covers is crucial. It's equally important to understand its limitations, especially for roof repairs. Homeowners insurance usually doesn't cover roof damage in certain situations. Knowing these exclusions can improve your financial planning for potential out-of-pocket expenses. You can also consider adding coverage options if needed.

Common Exclusions in Homeowners Insurance Policies:

- Age-Related Wear and Tear

- Lack of Maintenance

- Improper Installation or Repairs

- Certain Natural Disasters

- Intentional Damage

Age, improper installation, and negligence or poor maintenance are the main factors for claims getting denied.

Age of the Roof: A Key Factor in Insurance Coverage

Like everything else, your roof has a set number of years of the expected lifespan. Unfortunately, after the roof has reached its expected lifespan, it is likely to start developing problems due to material failures and constant exposure to nature. The most common roofs have a life expectancy of 15-20 years, so insurance companies offer limited or no coverage for roofs that are that old.

While properly maintained roofs can last longer than their expected lifespan, we recommend that you prepare to update your roof as it nears the end of its lifespan. This is to avoid the expensive roof leak repair costs we see associated with older roofs.

Insurance Exclusions for Improper Roof Installation

Hiring an inexperienced contractor might seem like a good decision while shopping for a new roof, but it is not in the long run. Investing in a good quality roof is essential to getting the most out of your roof in the long run. Along with investing in a great roof comes investing in a great roofing contractor to install it. It's not enough to just have an okay roof or try to do it yourself.

When you install your own home's roofs yourself it becomes exponentially more difficult and dangerous if even possible to ensure proper installation and quality. Installing the wrong type or style of roof can also lead down some pretty shady roads like leaks galore which is why we recommend hiring pros only!

Negligence and Lack of Maintenance: Insurance Claim Implications

Your insurance only covers damages if you follow the right maintenance schedule. Which is why we recommend regular maintenance for your roof. To keep up with the maintenance of your roof, make sure that all debris is clear from the roof, check for algae and moss growth, and keep your gutters clean to ensure that there are no clogged drainages.

Additionally, you should trim any trees growing near your roof to minimize damage from moisture and falling branches. To learn more about how to do regular maintenance to keep up with the health of your roof check out our roof maintenance checklist.

How Do You Make A Roof Repair Insurance Claim?

Claiming damages is sometimes tricky, especially when you’re doing it for the first time. Below are four steps you can take to make insurance claims go as smoothly as possible:

1. Maintain a Photo Album

You should always maintain a photo record of your roof’s condition to minimize going back and forth with your insurance company. Having before and after pictures could be the difference in getting your roof repair approved!

2. Conduct Maintenance

No matter how new your roof is, you can’t claim insurance unless you keep your roof well-maintained. Never delay roof leak repairs because damaged roofs are more likely to collapse or leak, which can damage your property and belongings, and possibly pose a threat to life.

3. Immediately Call Your Insurance

After you notice any roof storm damage, call your preferred professional roofer and then immediately call your insurance carrier. Most companies have a defined timeline during which you can claim damages. At this point, your insurance carrier will assign a field adjuster to come out and inspect the damage and start the process for your claim. Here at RoofCrafters, we like to meet the adjuster to go over the entire scope of work that will be required to make the repairs to make sure nothing is left out.

4. File Storm Damage Claim

Always file a roof storm damage claim after contacting a roofing contractor to inspect and confirm that you have storm damage to your roof and that the repairs are going to be greater than your deductible.

This way your insurance does not start a claim with no damage or sometimes it’s just not enough damage to meet your deductible and these claims once opened by you will go against you when it’s time to renew your homeowner’s policy even though they get denied for not enough damage.

This is very important and we see other people recommending calling your insurance company first and that is not the best practice. Make sure you have damage and the damage will exceed your deductible, then we call to file the claim. We also will make a temporary repair to mitigate any further damages until the work can be scheduled.

Does Homeowners Insurance Cover Rental Properties?

Insurance companies have policies that protect the landowner and renter in case of accidents. If you live in a rental, contact your landlord immediately if you suspect any damage. While a renter does not have to claim insurance for the leaky roof, insurance companies offer a renters insurance policy that allows you to protect your belongings in case of accidents.

For landlord insurance, the process is to analyze and document any damage before calling up your insurance company. You should leave things as is while the insurance adjuster comes to inspect the damage and processes the claim.

Clarifying Homeowners Insurance Coverage for Roof Repairs

Homeowners insurance covers roof repairs due to accidents or weather. As a homeowner, you must understand your responsibilities for roof maintenance. This is crucial to be eligible for insurance claims.

Proactive Homeowner Responsibilities

- Regular Maintenance: Consistent maintenance is key. Ensure your roof is free from debris, check for signs of algae or moss growth, and keep gutters clean to prevent water clogging. This regular upkeep is essential in upholding your insurance policy's terms.

- Routine Inspections: Conduct frequent visual inspections of your roof. Look out for signs of damage or missing materials and contact a professional roofer if you notice any concerns. Early detection of issues can prevent larger, costly problems down the line.

Importance of Professional Help

- Avoid DIY Repairs: Attempting to fix roof damage on your own can lead to further harm and potentially higher repair costs. It's advisable to rely on professional roofers who have the expertise and tools.

- Temporary Measures Post-Damage: If your roof sustains damage, take immediate steps to secure it. This helps mitigate further damage to your property while your insurance claim is being processed.

Partnering with RoofCrafters

RoofCrafters has satisfied customers in South Carolina, Georgia, and Florida. For 3 decades we've offered expertise and guidance for insurance claims. If you suspect damage to your roof or have questions about homeowners insurance coverage, schedule your inspection with RoofCrafters today. Let us assist you in ensuring your roof repair journey is smooth and well-managed.

My name is Anthony, and I am the lead estimator of RoofCrafters’ Georgia/South Carolina division. The roof is the most important part of a structure, and people count on that to protect themselves and their families. That is one of the many reasons why I love my job and enjoy coming to work every day. The continuous training, honesty, and providing the customer with the Roofcrafters experience is what makes me the best in the business.