Navigating Post-Claim Procedures for Roof Storm Damage

December , 2023 | 9 min. read

Found out your roof got damaged in the last storm? That's tough. But good job on getting it checked and ready to file a claim with your insurance. We at RoofCrafters know this part can be pretty overwhelming. For 3 decades we've been helping folks in our community navigate the insurance claims process.

Sometimes, it's like being in a boxing ring with the insurance company to get them to cover everything. We get it and know how to help make this as easy as possible for you.

If you're here, you've probably checked your property and found out the storm did a number on your roof. You may have called and filed your claim already. Great job and you're in the right place!

In this article, we'll show you what to do when the insurance folks call to set up their inspection. We'll explain what happens after they say yes to your claim and how to get your roof fixed up. Ready to start? Let's go!

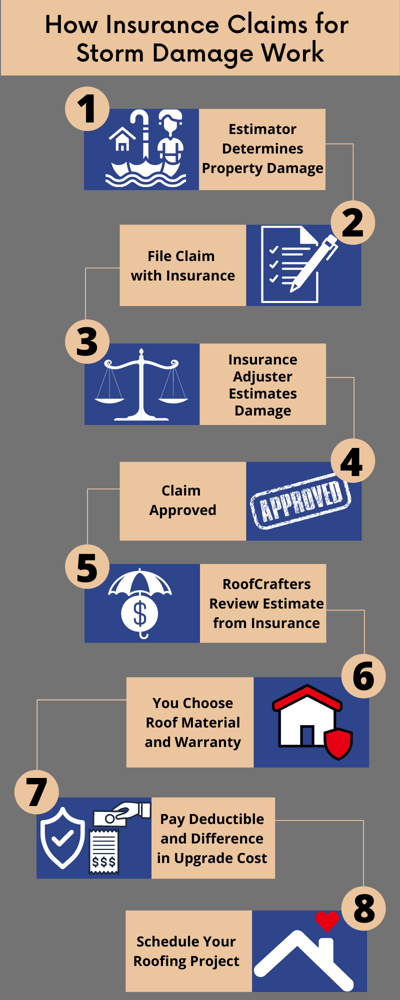

RoofCrafters' Step-by-Step Guide to Handling Insurance Claims for Storm Damage

Dealing with roof storm damage can be a hassle, but RoofCrafters is here to simplify the insurance claim process for you.

Here's how we tackle it:

- Confirm the Damage: We start by inspecting your roof to confirm the extent of the storm damage.

- File the Claim: You'll need to call your insurance carrier to officially file a claim.

- Adjuster Inspection: The insurance company assigns an adjuster to inspect the damage.

- Claim Approval: Once your claim is approved, we're one step closer to fixing your roof.

- Review the Work Scope: RoofCrafters will review the adjuster's scope of work to ensure nothing is overlooked.

- Material and Warranty Selection: Choose the materials and warranty that best suit your needs.

- Your Financial Part: You're only responsible for the deductible and any extra upgrades you opt for.

- Schedule the Project: Finally, we schedule your roofing project to bring your roof back to top condition.

We put our 30 years of experience to work. You can trust that your storm damage claim and roof repair will be handled professionally and efficiently. RoofCrafters is committed to making this process as stress-free as possible for you.

What Should I Do When the Field Adjuster Calls to Schedule My Inspection?

Your roofing company has determined that your property does have roof storm damage and you filed a claim with your insurance company. Shortly after your claim is reviewed, a field adjuster will be assigned your case. The field adjuster's job is to be the eyes for your insurance carrier, or the boots on the ground, so to speak.

The adjuster will come out to your property and first confirm the damage. They will also take photos and measurements as well as document all of their findings to show your insurance company why the claim needs to be approved or denied. Also, they are responsible for writing up an Xactimate estimate for all of the repairs that will need to be made as a result of the storm damage.

This is where it gets subjective since we are all still human the last we checked, mistakes can and will happen. Unfortunately, insurance is a business and not funding a project. This means more profit for the insurance companies. When mistakes happen, your claim will be underfunded. Or in the worst cases, they get denied!

Should My Contractor Be Present During The Field Adjuster’s Inspection?

To help avoid your claim from being underfunded or even worse, denied, we recommend that a representative from your roofing company is present for the initial inspection appointment. By a contractor being present at the time of the adjuster’s on-site inspection, they can point out all of the damage that was found and documented by the estimator on your behalf. Also, they will be able to discuss any local building codes that are required to replace your damaged roof.

The simplest way to make this happen is to collect their contact information and let them know that your local contractor will contact them immediately to schedule the appointment for the inspection on your behalf. Does this mean your claim is guaranteed to be approved and properly funded? No, however, having a second set of experienced eyes and ears during the adjuster’s visit is incredibly helpful.

It takes time and a great deal of effort to get everything needed to complete the project to get all of the bids, materials, and labor that are required to get your roof back into a pre-storm condition. The good news is that your insurance company pays your local contractor to do this for you. Now that you know what to do when the adjuster calls, let's discuss what to do once your claim gets approved.

Next Steps After Your Insurance Claim Approval

Great news, your claim has been approved! You will most likely receive an email that your claim has been approved but wait, and you will also receive an estimate from the field adjuster. This is going to be a detailed estimate of what they believe needs to be done to make all the repairs to your property.

All insurance companies use the same Xactimate estimating software to create, calculate, and determine the amount of the claim. Once you receive this estimate, you will forward their estimate over to the estimator that you are working with from your roofing company.

Reviewing the Adjuster's Estimate with Your Estimator

Your estimator will go over the adjuster’s estimate and make sure no items were left off. Mistakes happen, and we are not claiming that they are intentional, but they happen. These claims are often very complex, and many items are required to be replaced to make storm damage repairs.

If your estimator finds missing items, they will simply reach out to the desk adjuster at this time, which is the field adjuster's superior. They will then provide documentation for the items that were not included so that they can be added to the estimate before scheduling any work.

Scheduling the Start of Your Roofing Project

With the insurance claim sorted, the next step is picking the right roofing materials and deciding on the warranty for your project. Your insurance company will only pay for the same type of materials you had up there. They'll also cover any code upgrades. However, at this time you have the option and the right to use the funds provided to replace what was damaged with the same type of material, or you can upgrade. If you choose to upgrade, you will only be responsible for paying the difference in the cost of the materials.

The only thing you are not allowed to do is downgrade materials or profit off of your insurance company. It is estimated that over 10% of claims are fraudulent. That is considered insurance fraud, and it is a felony offense.

If you want to use the money to upgrade, that is perfectly legal and highly encouraged as it provides you and your property with better coverage. Many homeowner’s insurance companies even offer a reduced yearly premium for using upgraded roofing materials such as ice and water shields over the entire roof instead of a traditional felt paper or a higher grade shingle that provides a better wind warranty.

Finalizing Your Material Choices and Payment

If you choose to stay with the same materials as you had on your home before the storm damage occurred, all you will be required to pay, by law, is your insurance policy deductible. If you choose to upgrade, you will pay your deductible plus the difference in cost for the upgrades.

Your estimator will come out and go over all of these options and help you pick your materials, colors, and warranty level. After you make your selections, your project will go on their production schedule and you will receive a start date once they have all the materials needed to perform the work.

Related Article: “Should I Stay Home During My Roof Replacement?”

Wrapping Up: Navigating Through Your Roofing Insurance Claim Journey

Now that you know what to do when the adjuster calls to schedule the initial inspection appointment, what to do once you receive the Xactimate estimate from the adjuster, and your next step to getting your roof storm damage repaired.

Dealing with roofing insurance claims after storm damage can feel overwhelming, but it doesn't have to be. With your insurance claim approved and your roofing materials picked out, you're moving in the right direction.

Remember, you'll only need to pay your insurance deductible for similar material replacements. If you decide on upgrades, you'll cover the extra cost.

Count on your local roofing experts to help you choose the right materials and set up your roofing project. With a bit of patience and expert guidance, your roof will be fixed up and ready to protect your home again. RoofCrafters is here if you need any help on your journey from claim approval to project finish. Your home's safety and your peace of mind are our top priorities.

My name is Anthony, and I am the lead estimator of RoofCrafters’ Georgia/South Carolina division. The roof is the most important part of a structure, and people count on that to protect themselves and their families. That is one of the many reasons why I love my job and enjoy coming to work every day. The continuous training, honesty, and providing the customer with the Roofcrafters experience is what makes me the best in the business.