Navigating Roofing Costs: When Your Estimate Exceeds Insurance Claims

December , 2023 | 9 min. read

It's tough to handle roof damage, especially understanding the costs of fixing or replacing it. The process often involves many steps. From initial evaluations by roofing professionals to detailed assessments by insurance adjusters. When the roofing estimate exceeds their insurance coverage, many homeowners become confused.

It's frustrating, we get it.

We've spent three decades in the roofing industry. Our family at RoofCrafters knows just how overwhelming this can seem. Based on what we've seen, going from estimating to making insurance claims can be unclear for property owners. Which is why we're here to guide you. You deserve clarity and peace of mind,

So in this article, we'll demystify the process. We're going to explain what roofing estimates and insurance claims involve. We'll cover why there can be discrepancies between the two, and what steps you should consider next. Let's unravel these complexities together. That way you're well-prepared to handle your roofing project with confidence.

Understanding Roofing Estimates: How Costs are Calculated for Your Project

First and foremost, let’s break down the basics. A roofing estimate is a ballpark range of costs associated with your repair or replacement project and is typically given to the homeowner (or business owner for commercial properties) once the estimator has completed their inspection process. Estimators will use their industry training and knowledge to provide their clients with a rough number based on the steepness or the size of their roof.

It’s important to note that estimates will vary depending on the roofing company, and oftentimes cheaper or lesser-known companies will try to take advantage of clients during this process, so be diligent and receive more than one estimate before you make your final decision! At the end of the day, your roofing estimate should be within 5% of your final roofing quote, and should include the following:

- The scope of work

- Materials list

- Warranties

- Contractor overhead

- Payment terms

- Additional project details

Navigating Roofing Insurance Claims

If you’ve recently suffered damage of any kind to your roof, you’re going to want to file a claim with your insurance company. When you file a claim, keep in mind, it starts the entire process. Filing a claim that doesn't meet your deductible will still count against your policy as a claim filed. But, you don't receive any insurance benefits. The insurance company assigns an insurance adjuster and a lot of work happens behind the scenes.

When filing a claim, you’ll need to have someone come out to make sure it is safe to be in and around the house. Second, you’ll need to secure the house. As a policyholder, we must mitigate any further damage to our property. In most cases, this means protecting the home's inside from water intrusion.

Having a licensed roofing contractor come out and perform an inspection will end both steps. The contractor should take photographs and document any damage before covering these areas with a tarp. This will prevent the adjuster from needing to remove the coverings to see the damage. Keeping your house secure until the roof can be repaired is a priority.

The Process After Suffering Roof Damage

Here’s what happens once the call is made to report that you have storm damage and would like to open a claim.

- Your insurance carrier will assign you a field adjuster

- The field adjuster will contact you within 72 hours to confirm a date for an onsite inspection.

- The field adjuster will arrive on the confirmed date and perform an onsite inspection

- The field adjuster will take measurements, and photos and document all damage.

- The field adjuster will then return to their office and write the claim using an estimating program called Xactimate.

- The field adjuster will turn the written estimate over to their superior(desk adjuster) for final review.

- The desk adjuster will approve or deny the claim based on the photos and recommendations.

- Once the claim is approved the desk adjuster will return the Xactimate estimate to the field adjuster.

- The field adjuster will then send you the approved Xactimate estimate.

Why Is My Roofing Estimate Higher Than My Insurance Claim?

If you’ve received your roofing estimate for your repair or replacement and realize it’s higher than your insurance claim, there are a few reasons this may have happened. Most commonly, though, this has to do with the estimating program, Xactimate, or a difference in the scope of work. Which could mean your contractor and your insurance carrier dis not quote the same scope of work or materials.

Xactimate: The Preferred Estimating Tool Used by Insurance Companies

The estimating program that 90% of insurance companies use is a software called Xactimate. According to United Policyholders, “Xactimate® is a computer software system for estimating construction costs that has become widely used by insurance companies in the past decade. Insurance company adjusters use it to calculate building damage, repair, and rebuilding costs. Adjusters use Xactimate to generate loss estimates and claim settlement offers.”

Xactimate takes the median range of prices for the necessary materials and labor needed for the repair and replacement, which is how their final price is calculated for the claim. So, your insurance company isn’t setting the price, and neither is your contractor - Xactimate is.

The program then takes the median price for the materials and labor needed and that's how they derive the pricing for their claims. Neither the insurance company nor the contractor is. Roofing contractors tend to use the most accurate numbers when calculating their estimates, while Xactimate has been known for delayed pricing or even pricing changes.

Why? Well, the software isn’t up to date on roofing industry changes and trends, such as material price increases, so pricing modifications can take several weeks while Xactimate catches up. In turn, your roofing estimate could differ from your insurance claim from Xactimate due to pricing errors or even miscalculations.

Scope of Work Discrepancies: Understanding Variances Between Estimates and Claims

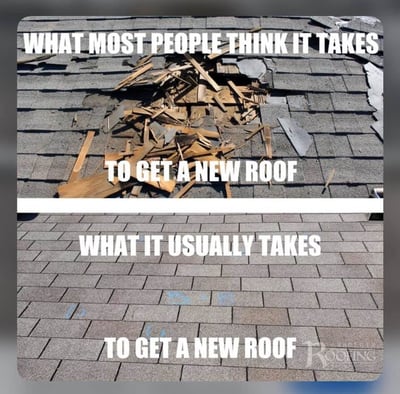

The second reason why your roofing estimate may be higher than your insurance claim is due to the project’s scope of work. Your claim may be missing a few or even several different items that the insurance adjuster missed but are necessary to the project. An insurance adjuster’s eye will never be as keen as an experienced roofing contractor's, and sadly, some of the time they won’t account for what it will truly take to get your roof back into perfect working condition.

Because of this, the scope of work that’s written in your contractor’s estimate will oftentimes consist of more line items than the insurance claim will. This may be the reason your roofing estimate is a bit higher than your insurance claim.

Also, your contractor’s pricing points may be higher because they're basing the scope of work on real-time costs; roofing materials and labor costs tend to fluctuate depending on the time of the year. Prices are impacted by several things, such as oil prices, material shortages, supplier demands, etc.

So, if your roofing estimate is higher than your insurance claim, it’s most likely because your contractor is up to date on industry costs and trends, which is not necessarily in the realm of any insurance adjusters' expertise.

Related Article: Why Do Some Roofing Contractors Charge More Than Others?

Handling a Higher Roofing Estimate: Steps to Take When It Exceeds Insurance Claims

If your roofing estimate is higher than your insurance claim, don’t panic! It's okay! This happens sometimes. Your roofing contractor knows a lot about roofs and might see things that your insurance adjuster missed. They can add those things to your insurance estimate to make sure your roof gets fixed right. Or, maybe there was a mix-up with the insurance company's cost calculator, Xactimate.

Here's what you can do: talk to both your roofing contractor and your insurance company. They can help answer your questions and explain why there's a price difference. They'll go through everything step-by-step so you understand what you're paying for. Either way, it’s simple: keep a line of communication open with your roofing contractor as well as your insurance company.

They’ll be able to aid you with any questions or concerns you may have about the difference in their pricing and will break down the process for you so that you can better understand what you’ll be paying for. That being said, it’s important to acquire several different roofing estimates before choosing the company that’s the best fit for your roofing needs. If you’re struggling to find the best contractor for the job, be sure to download “The Top 10 Most Critical Questions You Want to Ask Your Potential Roofing Contractor”.

This checklist includes several different prompts to ask your roofer to prepare you to hold the company accountable for its quality of work and services when it comes to your upcoming roofing project, whether that be on your family home or your commercial business. Our family at RoofCrafters would be glad to assist you to get your storm damge repaired.

My name is Cassie, and I’m the Content Manager here at RoofCrafters. I was born and raised in Chicago, Illinois, and made my way out to Florida post-college graduation. I’m incredibly passionate about writing and creating valuable content that helps others with the collaboration of my marketing team. When I’m not working, I enjoy shopping (a little too much), spending time at the beach, and reading!